Training and seminars

We conduct public seminars, corporate in-house training and term courses. Our programmes are conducted by highly qualified facilitators / trainers with requisite corporate/industry experience.

In-house training can be tailored to the needs and requirements of the company involved.

Ongoing Zoom Online Masterclass Conducted By Michael Matthew Lee

From Accountant to CFO/Finance Leader to COO/CEO

You will notice that the 3 Masterclasses are designed to chart the career path of accountants and Finance Leaders, as follows:

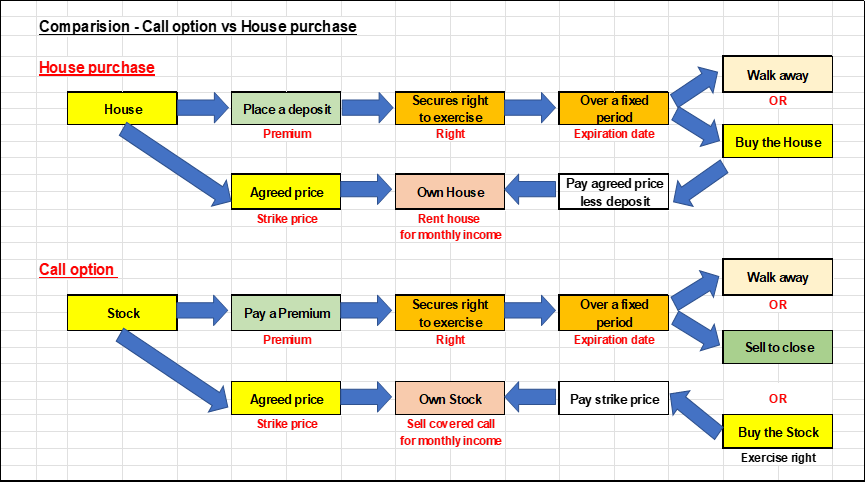

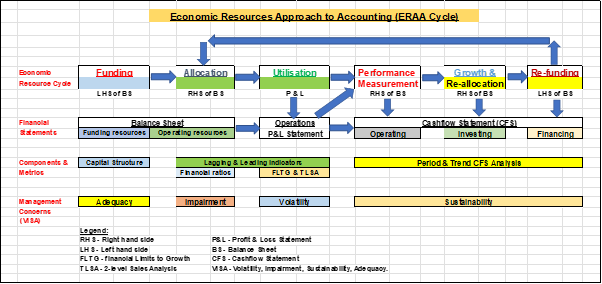

1. TFMM – teaches the Accountant/Finance Leader to be competent in all Accounting & Finance topics that matter for career enhancement.

2. TFLB – teaches the Accountant/Finance Leader to be a competent CFO.

3. FLST- teaches the Accountant/Finance Leader who are aspiring to be COO/CEO or supporting his CEO’s strategic planning role. This is a skillset which is highly in demand!

Consultancy

The scope of consultancy is wide-ranging, from resolution of a corporate issue/problem to special projects. Most consultancy work will require expertise from other professional disciplines and we shall work and coordinate with these professionals to achieve the objective(s) of the exercise.

Welcome To Our CFO

The CFO Desk Pte Ltd was incorporated on 18 March 2014 with the mission to help:

– Enhance the understanding and appreciation of Accounting and Finance in the public and professional sectors through training, seminars and coaching

– Companies resolve management issues and problems in Accounting and Finance

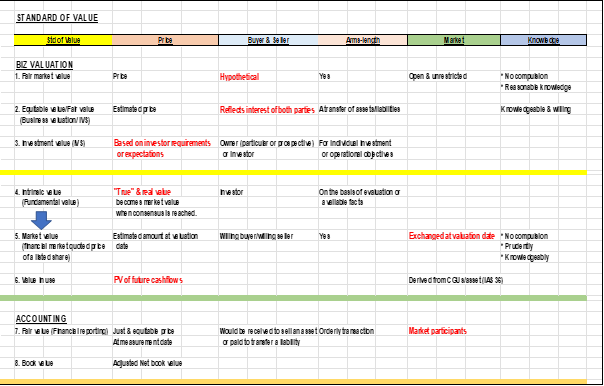

-Companies which require business valuation services