Cashflow Statement – An Enhanced Presentation

26 Apr, by

Cashflow Statement – An Enhanced Presentation

Author: Michael M Lee

- Introduction

The current practice in Cashflow Statement presentation under IAS 7 allows for comparability choices across firms and industries. Some of these are:

a. Applying the indirect method or the direct method. Most companies apply the indirect method

b. In applying the indirect method, companies can either begin the statement with Profit before tax (PBT) or Profit after tax (PAT).

c. Interest paid or received can either be treated as an operating activity or a financing activity.

d. Dividends received can either be classified as operating, investing or financing cashflows.

Such comparability choices do not help the user of cashflow statements in fully understanding the underlying strength (or weakness) of the company under review. It may, at times, distort the company’s cashflow position.

- The critical information needed

Board members and senior management face a constant challenge when reading the company’s cashflow statement. As cash is the lifeblood of the company especially in these trying times, they need to know what “fully cash” profit after tax is. This is not shown anywhere in the current presentation of the cashflow statement. The closest hint is the line “Cashflow from operating activities”. But this is not at “profit after tax” level when interest paid or received is taken up as financing activity.

As we know the PAT is not fully in cash because the starting point of sales in the P&L Statement captures credit sales as well. This is moderated by purchases of products and expenses on credit. Therefore, to know the cash gap between PAT (non-fully cash, extracted from P&L) and PAT (fully cash, from cashflow statement) is helpful and enlightening, especially to non-finance trained users.

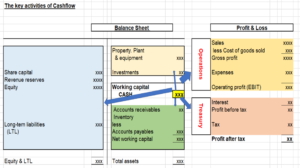

- Key activities of cashflows

The current cashflow statement delineates 3 types of cashflows the company’s cash asset is involved in, viz

a. Cashflows from operating activities

b. Cashflows from investing activities, and

c. Cashflows from financing activities.

To enhance the presentation of the cashflow statement, we will need to compartmentalise the P&L Statement into Operations and Treasury. Treasury encompasses interest and tax activities. For want of a better description, I shall call these activities as Treasury (or perhaps Finance) functions. This is to be distinguished from the financing activities which the company’s cash asset engages in on the Balance Sheet side.

Working capital components, operations activities and treasury activities work hand in hand to generate fully cash PAT to basically fund its necessary investment activities for the sustainability and growth (or expansion) of the company. When such funding falls short, the company must seek funding activities to protect its going concern assumption. Of course, at the same time, cash may flow in from disposal of investments or fixed assets and flow out to service debts and repayment of loans.

In companies where dividends are being paid, such payments must come from operating cashflows. In the current Cashflow Statement presentation, it is not clear if this is so because the reader is not privy to the chronology of cashflow activities.

To enhance the Cashflow Statement, we must therefore recognise 4 cashflow activities, viz.

a. Cashflows from operating activities

b. Cashflows from treasury activities

c. Cashflows from investing activities, and

d. Cashflows from financing activities.

- Proposed enhanced presentation

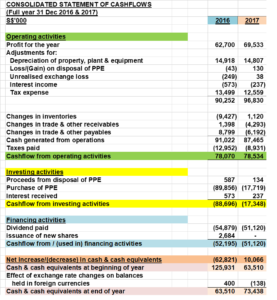

The Cashflow Statement that follows is extracted from a Singapore public-listed company.

The company does not pay interest because there was no long-term borrowing. As it has deposits of cash collections which are invested, it treats interest income as an investment activity, not part of operations/treasury activity. It is presumed that dividends are paid out of operating cashflows.

The proposed enhanced Cashflow Statement (below) highlights the areas the Board and Senior Management (shareholders and investors as well) are most concerned about.

a. How much of P&L PAT is truly in cash? What is the cashflow gap?

b. How is the cashflow gap arrived at?

Normally PAT (fully cash) must be greater than P&L PAT because of non-cash items. Sometimes it may not be and this is an area for auditors to probe into.

There are basically 2 components accounting for the cashflow gap, viz non-cash items (depreciation and provisions) and movements in working capital.

c. Are dividends paid out of operating cashflow?

d. How much is truly invested for maintenance of fixed assets and/or for corporate growth. This enhanced presentation excludes “interest received” which distorts the true investment effort.

Some of the key highlights of the proposed enhanced Cashflow Statement are:

e. “Operating activities” is now headed as “Operating & treasury activities”

f. “Profit after tax” is now amended to “Profit after tax (non-fully cash)”. Always start with PAT and not PBT or EBIT as PAT continues from where the P&L Statement left off.

g. Have an additional description “EBITDAP” or “Earnings before interest, tax, depreciation, amortisation and provisions”.

The line item EBITDAP is the so-called “proxy cashflow”.

h. Three line items summarise

- Cashflow generated from operating activities,

- Cashflow generated from treasury activities, and

- Profit after tax (Cashflow gap)

i. Finally, “Profit after tax (fully cash)” captures the cashflows generated by operating & treasury activities. This line item describes what the Board directors, senior management, investors, public inquirers, etc are looking for. And it is easy to grasp for the non-accounting trained among them.

j. Notice that there is an asterisk to indicate from where dividends were paid out. This adds clarity to the Statement.

- Cashflow health of the company

This presentation allows the PAT Cashflow Gap to be highlighted and enable further analysis of its severity or otherwise.

First, the cashflow gap must be positive. If negative, then there may be serious understatements in the P&L and/or negative overstatement of the movements of working capital. Both must be scrutinised.

Secondly, on the non-cash items (typically depreciation) we can inquire whether there is excessive fixed assets (causing high depreciation) to support the business or an inadequacy of such assets (low depreciation due to lack of replacement/maintenance/upgrading).

Thirdly, working capital movements (which also accounts for the cashflow gap) reflect the effectiveness and efficiency in the management of working capital, and must be analysed at component level.

To reiterate, the enhanced presentation highlights the cashflow gap, the analysis and understanding of which is vital to an appreciation of the company’s going concern assumption.

The examination of the cashflow gap is critically important and it must answer 3 questions:

a. Is there enough operating cashflow to support the growth of the company, through its investment activities?

b. Will there be enough to pay dividends, according to the company’s dividend policy.

c. Is operating cashflow sustainable?

For a deeper insight into this area, we must perform a trend Cashflow Statement analysis.

- Conclusion

The Cashflow Statement is a period statement with a past period comparative. What is important is the question of whether the company’s cashflow is sustainable. With a 2 period cashflow analysis, not much can be gleaned from the statements to indicate sustainability.

Sustainability of cashflow can threaten the going-concern assumption of the company, which the Board, Senior Management, shareholders and auditors are most concerned about. The proposed enhanced presentation of the cashflow statement helps in that process. But what complements the period cashflow statement analysis is the trend cashflow analysis, which will be discussed in my next paper.

———————————MM Lee 26Apr2020—————————–

Note: The ideas and presentation proposed are the author’s own and do not represent those of any institution or organisation.

About Michael Matthew Lee

Michael M Lee is a trained teacher, lecturer, coach and facilitator, and is himself a life-long learner. He is currently pursuing the Chartered Valuer & Appraiser Programme at Nanyang Business School.

Being trained, he is skilful in explaining difficult concepts in a simple and understandable manner. With his more than 40 years of corporate working experience, which include serving as Group CFO of 3 large Main Board public-listed groups, and as MD/CEO/COO of various companies across industries, he specialises in Finance and is exposed to senior executive management practices, issues and challenges. He adopts a practical approach to his training and facilitation.

Michael also runs his own company, The CFO Desk Pte Ltd, which is engaged in financial consultancy (corporate restructuring, IPO advisory, cashflow management) and business valuation, besides corporate training and public seminars.

Michael M Lee’s credentials are:

MBA (Finance, NUS Business School)

MBA (Strategic Marketing, University of Hull)

BAcc (NUS); DipM (UK);; PDipM (APAC); ACTA; PMC

ASEAN CPA; FCA(Singapore); FCPA(Aust); FCCA(UK); FCIM(UK); MSID.

Note:

Michael has written 7 accounting & finance articles to-date and they can be accessed through

Website: www.cfodesk.com.sg;

LinkedIn: “Michael M Lee”; and

Facebook: “Michael M Lee”

- 8 Oct 2018: “Debit & Credit” – Upon this Rock, the House of Accountancy was built!

- 17 Oct 2018: Financial Statement Analysis (an overview) – moving from lagging (historical) indicators to leading (predictive) indicators.

- 26 Nov 2018: Traditional Financial Statement Analysis –using lagging indicators (Part 1)

- 17 Dec 2018: Financial Statement Analysis – using leading indicators (Part 2)

- 24 Jan 2019: Financial Statement Analysis –Is there an optimal capital structure? (Part 3)

- 24 Feb 19: Financial Statement Analysis – What is V.I.S.A.? (Part 4)

- 7 Apr 19: Financial Statement Analysis – The V.I.S.A. Approach (Part 5)