Corporate Cashflow Sustainability – The Foundation for Corporate Growth

24 Sep, by

Corporate Cashflow Sustainability – The foundation for corporate growth.

Author: Michael M Lee (dtd 24 Sept 2022)

- Introduction

Current accounting & finance theory and practice emphasise only on cashflow projections to determine the cashflow health of the company. This is inadequate as it is short-term in nature and by design. We need an assurance how cashflows will behave beyond the projection period ie the company’s Cashflow Sustainability.

We are not able to ascertain Cashflow Sustainability because we currently do not have the tools to enable it. We are in a paradigm which is based on the entity concept and financial analysis is based largely on financial ratios which uncover what have gone wrong. They are lagging (historical) indicators!

To enable Cashflow Sustainability we need a paradigm shift. We need

a) To understand the flow of economic resources through the company and over long periods of time.

b) To create new tools which forewarn what could go wrong. These are leading (predictive) indicators.

c) To build a Cashflow Sustainability Framework and monitor it, and

d) To assess the presence of Cashflow Sustainability periodically.

- What is Corporate Cashflow Sustainability (CCFS)?

Sustainability is the ability to maintain a given matter or resource at a certain level, avoiding depletion or impairment and at the same time enhancing that level into the future. We talk about ESG (Environmental, Social and Governance) sustainability but to an organisation or enterprise cashflow sustainability must be first assured.

First, we must recognise that CCFS depends very much on generation of shareholder value, which comprises dividends, capital appreciation (share price increases) and cashflows.

Secondly, to develop CCFS, we must focus on the 2 key “engines of cashflows” ie capital structure and sales. The nature and composition of these “engines” must be well understood, protected, monitored, and enhanced.

Thirdly, we must realise that management is most concerned about the financial health of the company, and it is encrypted in the mnemonic V.I.S.A. which stands for

- Volatility of P&L

- Impairment of assets (Right-hand side of Balance Sheet)

- Sustainability of operating cashflows (in the Cashflow Statement), and

- Adequacy of funding (Left-hand side of Balance Sheet)

Fourthly, to satisfy ourselves with the financial health of the company, we apply appropriate financial ratios on V.I.S.A. to uncover what have gone wrong and./or what have done well. These financial ratios are historical in nature, and I call them lagging indicators. To develop CCFS, we need leading indicators to be in place. These indicators “predict’ what could potentially go wrong so that we are in time to take corrective actions before the impending disaster hits us!

Fifthly, we must understand the flow of economic resources within a company and how these resources transform into cashflows finally.

Lastly, we need to analyse trend cashflow statements to determine how the trend of P&L PAT (profit after tax) move with the trend of Cash PAT. When they dance in tune, they are “feeding each other” and CCFS can be assured.

An overview of the CCFS Framework is as depicted below.

Figure 1 – Cashflow Sustainability Framework

- What are leading indicators?

There are 2 types of indicators – lagging and leading. We have always been using lagging indicators such as financial ratio analysis to assess the health of the company. But that does not tell us about the company’s future threats and continuing financial health. For this, we will need leading indicators such as FLTG (Financial Limits to Growth) and TLSA (Two-level Sales Analysis), which I have created and explained in detail in my book “The Essence of Corporate Cashflow Sustainability”. Companies which are not aware of such leading indicators will be moving forward “blindly” without any clear and timely knowledge of impending disasters!

- How do we manage the 2 key “engines of cashflows”?

The 2 key engines are capital structure on the Finance side and Sales on the Operations side. Both Finance and Operations must work hand in glove for CCFS to materialise. In practice this may be challenging as their respective objectives may not converge. My book explains how this challenge could be managed.

For Capital Structure, we must appreciate the cost of equity and the cost of debt and their respective proportions, which leads to the computation of WACC (weighted Average Cost of Capital). The WACC is also the “hurdle rate” which is the yardstick for assessing the return on investment (ROI) for acceptability of investment (eg M&A, plant & equipment). It must be realised that WACC changes when the dollar proportion of debt and equity change, and/or their costs change. This could arise from a good quarter financial performance resulting in huge new retained earnings and/or a significant paydown or increase in debt. As a result, WACC increases (or decreases) and hurdle rate becomes higher (or lower), affecting the acceptability of new investments. The debt component also poses a financial risk (impinging on PAT/earnings) when it is unduly tilted in the capital structure!

For Sales, we will have to protect it from aggressive expansion without concern for additional resources (typically working capital) to support it. This is where FLTG tests come in. We also need to know when impending disasters appear on the horizon and whether sales are quality sales (based on returns and product portfolio analysis) with no concentration risks. These analyses can be done by applying the TLSA, which I have devised for these purposes.

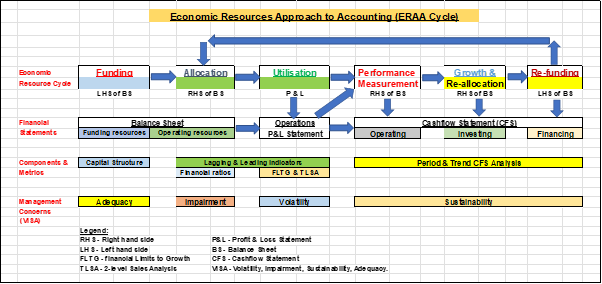

While properly managing the 2 cashflow engines, we must understand the flows of economic resources through the enterprise over the period. These flows will be captured and monitored under ERAA (Economic Resources Approach to Accounting) Framework.

- How do you build the ERAA Framework?

Economic resources (with its origin from the funding side) flow through the enterprise and are transformed finally to cash into the working capital to continue with the operations cycle. New funding resources will be required as the enterprise grows in its sales and operations.

The ERAA Framework identifies the stages of these flows from funding, allocation of funds, utilisation of allocated funds, performance measurement, de-funding/re-funding. The set of financial statements (Balance Sheet, P&L Statement, and Cashflow Statement) captures these flows and performance metrics are applied at each stage to ensure that they are headed in the right direction.

An overview of the ERAA Framework is as depicted in the diagram below.

The Framework builds the structure for cashflow sustainability to be maintained and monitored. It uses leading indicators to ensure that the 2 cashflow engines are operating effectively and in concert.

Figure 2 – ERAA Framework

- Examining the 2 key CCFS assessment metrics – P&L PAT and Cash PAT

It is not enough that the CCFS Framework is working well, operationally. Our key concern is whether Cashflow Sustainability is visibly present. To test this, we need to use 2 key CCFS metrics ie P&L PAT and Cash PAT.

P&L PAT is easily obtained form the current P&L Statement but to obtain Cash PAT, we need to make the necessary adjustments to the “Net cashflow from operating activities” in the Cashflow Statement. A detailed and clear understanding of the cashflow statement (the mechanics, presentation, and analysis) is required. This important area is discussed, step by step, in my book “The Essence of Corporate Cashflow Sustainability”.

We know that P&L PAT is a mixed bag of cash, non-cash (eg depreciation and provisions), non-operating items (gain/loss on disposal of assets), deferred receipts (accounts receivables) and deferred payments (accounts payable). With the adjustments of these item on P&L PAT, Cash PAT is derived. Cash PAT feeds into working capital to be used to support new sales and other operational activities and the working capital – operations cycle continues. We just need to ensure that both P&L PAT and Cash PAT feed each other to ensure cashflow sustainability. When we look at 2 years of P&L PAT and Cash PAT, we cannot be certain of their future directions. We need a Trend P&L PAT and Trend Cash PAT (of 3 years each) to establish a pattern indicating where the 2 metrics are heading. My book established 5 scenarios (Figure 1) for this to happen, two of which confirm the existence of cashflow sustainability.

- Where do we go from here?

When the Trend P&L PAT and Trend Cash PAT do not move in line to support each other, we will have to examine and fix the departments that cause the problem.

Earlier we indicated that we use lagging indicators to examine V.I.S.A. concerns. On a quarterly basis, after we operationalised the CCFS Framework, we can apply lagging indicators on V.I.S.A. analysis. This time the financial ratios must show improvements over the last quarters.

Based on the foregoing discussion, it is abundantly clear that CCFS is necessary to support continuing corporate growth.

- Summary & conclusion

It must be recognised that any economic and/or political disruptions cannot save a company from operational and financial failure. But with a CCFS Framework in operation, we may see the impending disaster ahead of time and make the necessary preparations to cushion the impact. And when the “storm” is receding, we may be able to “build back better”!

—————————————————————————————————————-

Michael Matthew Lee’s credentials are:

Chartered Accountant (ISCA)

Chartered Marketer (CIM(UK))

MBA (Finance, NUS Business School)

MBA (Strategic Marketing, University of Hull)

BAcc (NUS); DipM (UK); PDipM (APAC); ACTA; PMC, CertEd

ASEAN CPA; FCA(Singapore); FCPA(Aust); FCCA(UK); FCIM(UK); MSID.

Note:

Michael has written 12 other accounting & finance articles and they can be accessed through

Website: www.cfodesk.com.sg;

LinkedIn: “Michael M Lee”; and

Facebook: “Michael M Lee”

- 8 Oct 2018: “Debit & Credit” – Upon this Rock, the House of Accountancy was built!

- 17 Oct 2018: Financial Statement Analysis (an overview) – moving from lagging (historical) indicators to leading (predictive) indicators.

- 26 Nov 2018: Traditional Financial Statement Analysis – using lagging indicators (Part 1)

- 17 Dec 2018: Financial Statement Analysis – using leading indicators (Part 2)

- 24 Jan 2019: Financial Statement Analysis – Is there an optimal capital structure? (Part 3)

- 24 Feb 19: Financial Statement Analysis – What is V.I.S.A.? (Part 4)

- 7 Apr 19: Financial Statement Analysis – The V.I.S.A. Approach (Part 5)

- 26 Apr 19: Cashflow Statement – an enhanced presentation

- 28 Jun 20: Cashflow Statement – Period & Trend Analysis

- 3 Feb 21: The Economic Resources Approach to Accounting (ERAA)

- 18 Apr 22: Business Valuation – A primer

- 7 May 22: Business Valuation – Income Approach

Currently, embarking on writing a 2nd book entitled “Cashflow Sustainability and Corporate Growth” to be launched mid-2023, and is targeted for C-suite executives, locally and internationally. This book is a sequel to “The Essence of Corporate Cashflow Sustainability”.